Looking ahead, Latin America faces no shortage of policy challenges, and many (if not most) of these have domestic economic and political roots. The problems confronting individual countries vary markedly in origin, nature, and severity, so it would be misleading to discuss many of these at the regional level. The economic implosion inflicted on Venezuela by Maduro’s dictatorship registers on a separate scale, not only in comparison to the rest of the region but in the global and historical experience by almost any metric. Meanwhile, Brazil’s new government is attempting to tackle a daunting and worsening fiscal problem that is unsolvable without substantive pension reform. Argentina’s central bank continues to battle the old demon of chronic high inflation. Mexico’s new president has raised alarms among global investors about his “market-friendliness.” Despite these and other substantive differences across national borders, however, there is considerable common ground across the region in the challenges posed by the changing external environment.

“Historical” External Factors

The global cycle in world primary commodity prices has been a driver of prosperity and depression in Latin America (LATAM) economies since their independence.[1] Developments in the world’s financial centers (London in the 19th century and the United States since World War I) have also importantly shaped the region’s economic cycles. The severe financial crises in the US and Europe of the late 1920s and 1930s, coupled with a spectacular collapse in global commodity prices and a spike in real (inflation-adjusted) interest rates, brought nearly every Latin American country to a state of protracted economic depression and widespread default on their external private and sovereign debts. Capital, instead of flowing south, flowed north into the United States.

About half a century later, in order to reduce inflation, Federal Reserve Chairman Paul Volcker drove US real interest rates to their highest levels since the 1930s. As a result, oil and commodity prices crashed abruptly and the decade that followed came to be known as the Lost Decade of Latin America. Foreign capital only began to return to the region in the early 1990s, when the debt crisis had been resolved under the Brady Plan debt restructuring and US interest rates drifted lower.

My work, with Guillermo Calvo and Leonardo Leiderman (1993),[2] which documented LATAM’s return to international capital markets, presented formal evidence that external factors play a significant role in explaining capital flows and exchange rate developments in Latin America and that, consequently, there is a substantive degree of co-movement in capital flow patterns across countries in the region. We stressed the key role of US monetary policy and interest rates as drivers of the boom-bust cycle in capital flows to the region. Since then, a substantial literature has emerged that, for the most part, reiterates that general message for emerging markets (EMs) in general.

An influential paper by Hélène Rey (2015) has suggested an even more dominant role for a common global financial cycle.[3] In that paper, as well as others that examine the drivers of cross-border flows, the expected volatility of equity prices in the United States (as measured by the VIX, the forward-looking index of the volatility of equity prices traded on the Chicago Board of Options Exchange) plays a central role over and beyond interest rates. Periods of low expected volatility are associated with higher capital flows to EMs. A plausible interpretation is that in periods of low volatility, there is a lower premium on liquidity (as insurance against shocks) and investors are more willing to hold riskier and less liquid assets.

So, if historically external factors helped shape the Latin American economic cycle, how was it possible that LATAM thrived after the United States and nearly a dozen European countries sank into severe financial crises and deep recessions in 2008-2009 and beyond? Most countries in the region were affected by the global turmoil, to be sure, but the typical pattern was a steep contraction followed by a rapid and robust recovery.

Some observers claimed that LATAM’s resilience was evidence that superior policies were paying off and that the region was able to better withstand adverse external shocks. Indeed, at the time of the global financial crisis (GFC), EMs were “lean and mean,” having deleveraged over several years. External debt (public plus private) had declined to its lowest levels since the early 1970s, and many countries had amassed a war chest of foreign exchange reserves. Current account surpluses were commonplace, even in Latin America, where they are comparatively rarer. For most commodity producers, growth domestic product (GDP) growth ran above trend.

Some of the region’s policymakers went as far as to suggest that LATAM had decoupled from its historic dependence on external factors. As I will discuss, this view does not stand up to scrutiny (then or now). Within the usual set of “historic external factors,” US and global interest rates did not rise. Unlike the financial crisis of the early 1930s, the policy response of the Federal Reserve and other advanced economies’ central banks was to aggressively ease liquidity conditions, allowing nominal and real interest rates to decline markedly and stay in negative territory for years. In Europe and Japan, interest rates remain negative (in nominal and real terms) to this day. Most measures of volatility in financial markets, including the aforementioned VIX, also posted a remarkable decline after the crisis. This extended period of exceptionally low international interest rates and volatility following the 2008 crisis provided a conducive climate for capital to flow to EMs. It provided an incentive for governments and firms in Latin America and other EMs to borrow from international capital markets and, in their eternal quest for yield, it induced investors to lend.

In a different era, the severe and prolonged contraction in economic activity in the advanced economies, however, would have likely depressed global commodity prices and worsened the terms of trade of the commodity-dependent Latin American economies, as occurred in the 1930s. This did not happen after the 2008 crisis. “Traditional western-oriented” external factors fell short of providing a full picture of the global forces that were influencing LATAM.

The “Modern” China Factor

While the mature economies tackled severe recession after the crisis, a record fiscal stimulus package at the outset of the GFC helped to keep China’s economy expanding at record speed. For the decade centered around the 2008 crisis (2004-2013), real GDP growth averaged 10.8 percent, according to official sources.[4] Furthermore, China’s growth was driven primarily by commodity-intensive infrastructure investment. This combination from an economy that in a few years’ time moved to second place as a share of world GDP fueled the longest commodity price boom since the late 18th century.[5] The episode was one long bonanza for much of Latin America. Parallel stories were unfolding in Sub-Saharan Africa and other regions where primary commodity exports are dominant.

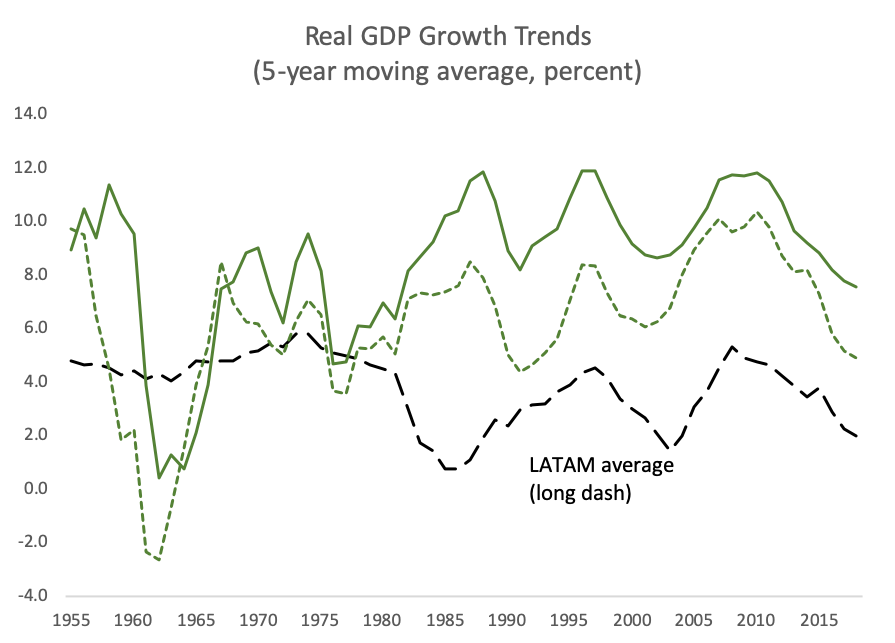

Apart from its dominant presence in world commodity markets, China’s footprint in global finance was also expanding dramatically. Among the lower-income countries, development loans soared. Chinese lending was also growing rapidly to the oil producers. Venezuela’s now-notorious loans stand out in this regard, but Ecuador’s debt to China also expanded during this period. Apart from debt financing, Chinese FDI was an additional new component of the capital inflows. During 2004-2013, growth in the largest Latin American economies averaged almost 5 percent, about 1.5 percentage points above the post-1950 average. Figure 1, which shows five-year moving averages of real GDP growth for China and LATAM, highlights the synchronicity in growth cycles. Since 1995, the simple pairwise correlation between the five-year growth rates is an impressive 0.76 (it matters little whether the Chinese official sources or an alternative estimate are used).

Figure 1. China and LATAM Economic Growth: The correlation of the five-year GDP growth rates of China and LATAM since 1995 is 0.76.

Note: LATAM aggregate for Argentina, Bolivia, Brazil, Chile, Colombia, Costa Rica, Dominican Republic, Ecuador, Guatemala, Mexico, Peru, Uruguay, and Venezuela. Alternate GDP estimate for China is published by the Conference Board.

Source: Conference Board.

While turbulence in LATAM has escalated in 2018, the true “bonanza” period for the primary commodity producers had come to an end by 2012, coinciding with the slowdown in China and the downturn in commodity prices. The so-called “Taper Tantrum,” following speculation about the Federal Reserve’s intention to taper (scale back) its large-scale stimulus program of quantitative easing in the spring of 2013, marked a definitive end to the boom period for Latin America.

Challenges Ahead

If for most of LATAM economic conditions were “lean and mean” at the outset of the GFC, the same cannot be said of the present. While the experiences vary considerably across countries, in the aggregate external borrowing picked up in the years that followed the crisis. In some cases, it was confined to the private sector, as in Chile (also seen outside the region in Turkey), where corporations did much of the borrowing. More broadly, both public sector and private external debt levels climbed in the post-crisis decade. Total (public plus private) external debt matters in the risk calculus because the recurrent historical crisis experience shows that private debts are private before the crisis, but became public after the crash. Private external debt is a contingent liability with teeth. While an external debt ratio of about 50 percent seems almost trivial by modern advanced economies’ standards, as Reinhart, Rogoff, and Savastano (2003) show, safe external debt thresholds for EMs and developing countries are quite low, and notably lower for those countries with a history of serial default.[6]

More troubling, however, is the fact that the officially reported external debt data is not the whole story. External debts to China, not well measured and not included in World Bank data, are estimated to add another 15 percentage points or so to this ratio in 2016-2017 for EMs (variation across countries is considerable). LATAM’s resilience to external shocks is not what it was ten years ago.

What are the highlights of the external conditions (in comparison to the bonanza decade)? China’s real GDP growth has almost halved; largely as a consequence of that slowdown, world commodity prices are significantly below their cyclical peak; US interest rates have risen, and further increases are possible; partially owing to the tightening in monetary conditions in the US relative to other advanced economies, the US dollar strengthened since 2017. A strong dollar is problematic for EMs like Argentina and others where much of the borrowing is in US dollars. It is noteworthy that the “dollar bloc” includes the countries that have borrowed from China, as these loans are almost exclusively denominated in US dollars.

Not surprisingly, capital flows to LATAM have declined markedly, especially in the past year. As external conditions deteriorated, economic growth has slowed significantly. According to the IMF’s World Economic Outlook, for the EM group economic growth has slowed by about 2 percentage points from the 2010-2013 average.[7]

There are signs that in the past year financial market volatility is on the rise. As noted, volatility measures, such as the widely followed VIX, had posted exceptionally low readings since the GFC. Low volatility, other things equal, has been found to be a quantitatively important factor in pushing capital to EMs. In the latter part of 2018, the VIX and other volatility measures have climbed back closer to some of the historic norms.

Finally, contributing to the less friendly global environment for EMs in 2018, negative contagion (although not crisis magnitudes) from other EMs has been a recurring feature. Argentina’s currency and LEBAC crisis, which led to an IMF program and ushered in a recession, Turkey’s currency collapse, South Africa’s populist rumblings and soft economy, Brazilian elections, and less-than-market-friendly signals for Mexico’s president have all tended to re-enforce the other global factors contributing to investor skittishness.[8] Importantly, investor sentiment may be carrying a bigger weight in overall capital flow outcomes, as the EM investor base has changed dramatically in recent years. Less is held by the multilateral institutions, and much more of it is held by non-banks (hedge funds, pension funds, and the like). According to several studies and recurring market commentary from the IMF and others, this component of the investor base is particularly prone to sudden reversal. Furthermore, much of the external debt is variable-rate, which does not protect borrowers in a rising interest rate environment.

The million-dollar question for policymakers coping with an uncertain external environment involves developing an ex-ante assessment of whether the shocks they face are temporary or permanent (or, at least, very persistent). Given the comparative unpredictability of foreign exchange markets, a plausible expectation is that the strength in the US dollar since 2017 (as noted, this increases the burden of those countries with dollar debts) may be reversed in the period ahead. Recent statements by Federal Reserve Chairman Jerome Powell appear to have a more dovish tone, so that gap between US monetary policy and its European and Japanese counterparts may be less than what had been priced into the dollar. In that vein, it may be that the upward trek in US interest rates has been (at least temporarily) halted. Taken together, these developments in the historical external factors point to a reprieve for LATAM borrowers, especially as it also supports commodity prices.

Less comforting to LATAM policymakers is the fact that the questions about China almost all involve concerns about whether it can consistently deliver its projected growth of around 6 percent (one-half of the growth in 2010), given its high levels of private and public debt, less competitive exchange rate, and more uncertain trade environment. Looking for a rebound from that quarter is a hope, not a strategy. Furthermore, China’s rebalancing from investment to consumption (even if limited in scope) is bad news for the prices of industrial commodities.

On balance, the external environment is one that is less growth-inducing and more volatile than the prior decade. While US monetary policy may play a neutral role, it is difficult to envision a Europe where negative nominal interest rates persist indefinitely. The bonanza decade ended some years ago. It is time for LATAM’s policymakers to have a serious reassessment of how that bonanza was managed.

Notes

[1] Carmen Reinhart et al., “Global Cycles: Capital Flows, Commodities, and Sovereign Defaults, 1815-2015,” American Economic Review 106, no. 5 (2016): 574-580.

[2] Guillermo Calvo et al., “Capital Inflows and Real Exchange Rate Appreciation in Latin America: The Role of External Factors”, IMF Staff Papers 40, no. 1 (1993): 108-151.

[3] Hélène Rey, “Dilemma Not Trilemma: The Global Financial Cycle and Monetary Policy Independence,” in Proceedings, Federal Reserve Bank of Kansas City Economic Symposium at Jackson Hole, 2015.

[4] Conference Board, n.d., https://www.conference-board.org/data/.

[5] Reinhart et al., “Global Cycles.”

[6] Carmen Reinhart et al., “Debt Intolerance,” Brookings Papers on Economic Activity 1 (Spring 2003): 1-74.

[7] International Monetary Fund, “World Economic Outlook Database,” October 2018, https://www.imf.org/external/pubs/ft/weo/2018/02/weodata/index.aspx.

[8] LEBACs are short-term, domestic currency securities issued by Argentina’s central bank. Large bunching of amounts coming due escalated roll-over risk, market illiquidity, and currency weakness at various points during 2018.